OBR corrects student loan figures from Economic & Fiscal Outlook

The Office for Budgetary Responsibility has corrected the tables it provided on student loans in last week’s Economic & Fiscal Outlook, which was published to accompany the Budget. A full explanation can be found here.

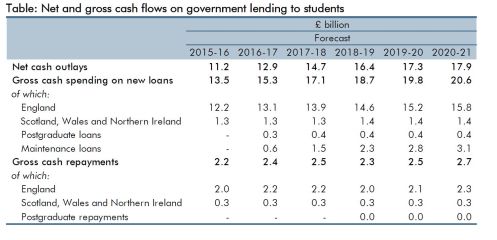

This table separates ‘English’ loans from the rest of the UK as well as the proposed English postgraduate loans. The row marked ‘maintenance loans’ only scores those loans created to cover the cuts to maintenance grants in England. All years are financial years (April-March) rather than academic years.

English repayments decline after 2017/18 owing to the impact of selling a proportion of the student loans issued before 2012 to the private sector. This remains the ‘expected’ policy of this government – with the first tranche of sales expected at the end of 2015/16.

The expected proceeds from any sale (c. £11.5bn) are dwarfed by the annual ‘net cash outlay’ requirements (first row) over the course of Parliament. This represents the difference between annual ‘gross cash outlay on new loans’ – which rises to £20.6biillion by 2020/21 – and ‘gross cash repayments received’.

This net cash outlay adds to the public debt over and above whatever contribution the ‘deficit’ makes. Understanding the Treasury position on loans depends on seeing these projected cashflows and their effect on the ‘pathway’ of public sector net debt, rather than whatever ‘loss’ on loans the ‘RAB charge’ represents.

For more detail see my Accounting and Budgeting of Student Loans.

Trackbacks & Pingbacks